Energy Model

The Energy modelThe Energy model reflects the amount of excess energy within a market. is shown on the Dashboard in the pro members' premium tools.

The Energy model is a computer model that generates analysis and information that are generally available to a broad audience and are not designed to be used independently to determine a specific financial investment, trade decision, or strategy.

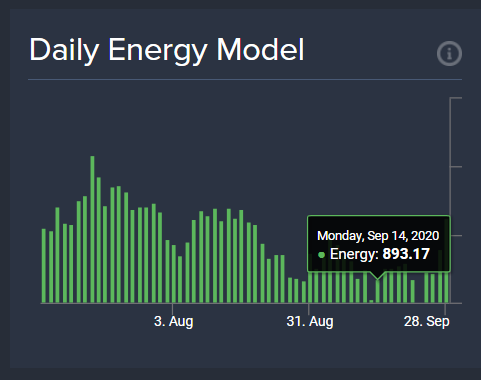

The Energy model analyzes the relative push‑and‑pull force between the bulls and bears in a covered market, providing a unique measurement of how much energy (that is, strength or weakness) remains in a market's current price movement.

This model analyzes to what extent the bulls represent the whole of a current market vs. the extent represented by the bears, illustrating the degree to which a market may be reaching its maximum entropy resulting from potential overbought or oversold conditions.

When the Energy model's direction closely aligns with price direction, it indicates a possible divergence of the two ahead (that is, direction change).

If the Energy model turns negative during a market sell‑off in a particular time unitThe time level being considered: days, weeks, months, quarters, or years., this is a sign that the selling or short positions may be bottoming out (that is, failing to make new lower lows), and a direction change may be ahead. Conversely, if the Energy model reaches a relative peakThe high; the highest point within a time series. during a market rally, this is a sign the buying or long positions may be stalling (that is, failing to make new higher highs) and a direction change may be ahead.

Use the Energy model in combination with other information, data points, and studies.

Covered markets with longer trading histories have more data, history, and time levelsOne of the five key viewpoints of time into which analysis is divided: daily, weekly, monthly, quarterly, and yearly. Also called a time frame. to analyze, increasing the potential usefulness of the Socrates Platform models.

Do not try to pick the exact time and price point of a given market's highest high or lowest low.

- No model or person can do this with any degree of consistency.

- Determine the right investment or trade opportunity for your circumstances based on your own budget, comfort level, experience, expertise, objectives, research, and risk management considerations.

- Every financial investment or trade involves the risk of financial loss. Give serious consideration to where to invest, and then manage your investments accordingly.

- Work with your own independent, qualified, financial service professionals.