Aggregate Model

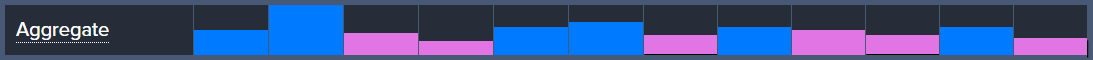

The Aggregate row represents the summation of the entire collection of Array models.

- The blue bar indicates a number that is equal to the previous blue bar or higher than the blue or pink bar in the previous time frameOne of the five key viewpoints of time into which analysis is divided: daily, weekly, monthly, quarterly, and yearly. Also called a time level..

- The pink bar indicates a number that is equal to the previous pink bar or lower than the blue or pink bar in the previous time frame.

- Bar height is standardized to the largest bar, providing a relative scale for the time frame.

- Aggregate peaksThe high; the highest point within a time series. (high bars) and troughsThe bottom; valley; the lowest point within a time series. (low bars) reflect possible turning pointsA point in time at which a market direction change occurs or may occur. Also called a target date.; however, it is important to understand that they are not necessarily market price highs or lows.

- Turning points tend to alternate with Aggregate bar peaks and troughs so, if one peak or trough aligns with a market high and then a turn-down, then the following peak or, as applicable, trough in the same time levelOne of the five key viewpoints of time into which analysis is divided: daily, weekly, monthly, quarterly, and yearly. Also called a time frame., may align with a market low and turn-up.

- It is best to focus on a monthly time level and correlate research with GMWGMW. One of four core Socrates Platform models. This pattern recognition model provides an objective computer analysis of all covered markets based on technical price movement, to provide a visual of what is unfolding on a global basis., reversalsOne of four Socrates Platform core models. The Reversal System is a computer model based on the theory that specific pressure points (the reversal points) exist within price movement., and other studies.

- Multiple Aggregate peaks and troughs over a short period of time tends to indicate that market price may be choppy with relatively frequent, alternating highs and lows.